The COVID-19 pandemic had a significant impact on lives, economies and, in many cases, health across the globe but has it also made a lasting change to the way we spend, save, and borrow – and the terms we are eligible for, based on our credit score?

Statistics, of course, show only one part of the picture, with countless negative financial outcomes, such as business closures and redundancies. Still, the restrictions on movement and travel may reflect how such an international crisis has made us reevaluate our financial habits.

The Coronavirus Credit Affect

As the dust settles, most international economies are working hard to overcome the cycle of inflation left behind. However, consumer credit scores may have benefitted from the period when governments heavily curbed spending on entertainment, travel and hospitality.

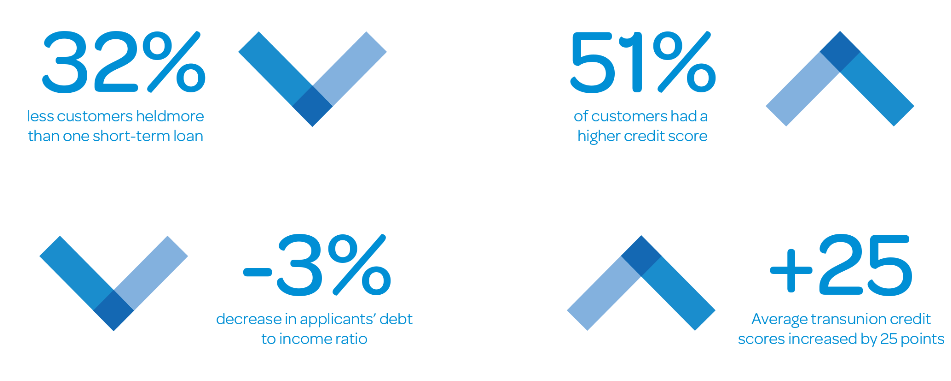

A COVID and Credit report published by Wonga shows that, on average in South Africa:

- 51% of people saw improvements in their credit score.

- The average TransUnion credit rating increased by 25 points.

- Borrowing applicants had a 3% drop in their debt-to-income ratio.

Image source: wonga.co.za

The Federal Reserve Bank of Boston echoed these findings, looking at US residents with previously low credit ratings. A sudden, sustained dip in credit card usage resulted in significant credit score improvements. Data published by Experian also shows that UK businesses recovered quickly, with the average score dropping by 9.1%, before rebounding back to equal the pre-pandemic average by September 2021.

What We Can Learn About Our Finances From the Pandemic?

Everyone’s experience of the pandemic may be different. Key workers were applauded and required to continue working throughout, whereas others may have been forced to close indefinitely or spent months at home without returning to the workforce.

Remote and hybrid working has grown exponentially as businesses and employees recognise the benefits and cost savings associated with a devolved workforce – and this isn’t a trend likely to change.

In terms of personal finances, there are a few key takeaways to consider:

- Cost savings: cooking and eating at home, watching TV instead of the cinema, and taking a daily walk rather than going to the gym are all substantially cheaper – although it remains important to support businesses for economies to grow. However, for lower-income households, the pandemic may have forced a step-change in the spending considered truly necessary.

- The importance of a contingency fund: some countries introduced support schemes where employees received a proportion of their salaries when unable to work, but many had a lower-than-normal income. This emphasised the incredible value of a savings pot, helping us to manage when our income drops without warning.

- Minimising debt load: the pressure of maintaining debt repayments and interest with a reduced income became apparent. Paying off multiple loans, credit cards, and a mortgage or car loan is expensive, and repayment should be a priority over unnecessary spending.

Overall, the impacts of the pandemic on our credit scores were relatively short-lived. Resuming typical spending will undoubtedly revert average ratings to the norm. But there is an opportunity to learn and adapt our financial habits for a more secure future based on how quickly, and widely, credit ratings improved.